Queenslanders are once again leading the surge for property trends across the country, as new data released from the National Housing Finance and Investment (NHFIC) Corporation shows residents of the Sunshine State snapping up loans as part of the First Home Loan Deposit Scheme.

New details into the scheme have shown it to be a fantastic initiative, particularly for two QLD postcodes leading the take-up nationally. The First Home Loan Deposit Scheme is an Australian Government initiative to support eligible first home buyers purchase their first home sooner. Under the Scheme, eligible first home buyers can purchase a home with a deposit of as little as 5 per cent. This is made possible by the NHFIC guaranteeing a Scheme lender up to 15 percent of the value of the property financed by an eligible first home buyer’s home loan.

In their latest report complied by the NHFIC, it was revealed that there was strong demand for the deposit financing scheme, which was accessed by "...people of all ages across metro and regional areas around Australia, and those who have moderate taxable incomes." In fact, the scheme supported one in eight of all first home buyers who purchased in Australia between the months of March and June 2020.

SOURCE: NHFIC

Although the scheme is currently being accessed mostly by younger people entering the property market, more than 10% were people aged 40 years. Guarantees for couples were also most prominent between the ages of 25-34, but at higher income earner levels between the $90k to $125k income bracket.

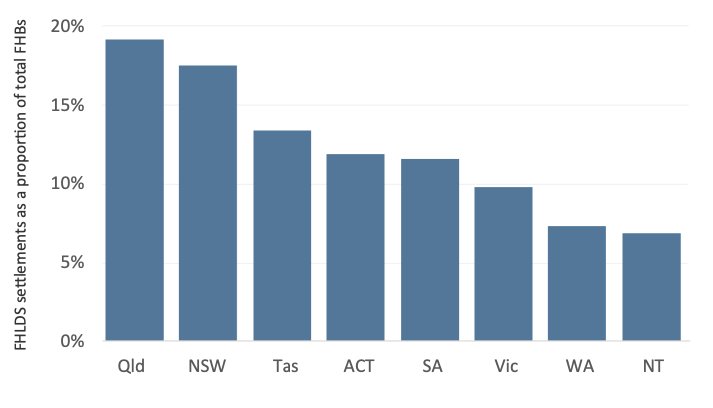

What shows Queenslanders to be most eager to capitalise on the scheme was the demand for people located in the Toowoomba area, with 70 loans guaranteed. By Postcode, this was the highest up-take on a national level. The report also shows that demand was strong across the southern states, with the geographic distribution of guarantees largely in line with the resident population share. In Queensland and NSW, one in six of all first home buyers accessed the Scheme over the March & June 2020 period.

First Home Loan Deposit Scheme settlements as a proportion of total first home buyer purchases - March 2020 to June 2020. SOURCE: ABS / NHFIC

“Almost 70 per cent of buyers using the scheme purchased a detached house, with 25 per cent buying an apartment and five per cent purchasing a townhouse,” the NHFIC report said, with the median purchase price sitting at $385,000 for houses and $475,000 for apartments – most of which were in capital cities.

The report also goes on to highlight that the Scheme has helped many first home buyers bring forward their home purchase. "As at 30 June 2020, the Commonwealth Government had guaranteed almost $400 million in deposit shortfalls for firsthome buyers across Australia," the report said. "NSW, Victoria and Queensland accounted for 87.4 per cent of the total amount guaranteed."

<< Read the full report here. >>

At Place Estate Agents, we're dedicated to keeping our eyes on the ball with the latest industry news, delivered to you. If you'd like to stay up to date with all things Brisbane real estate and more, including the latest Off-Market properties, subscribe to our weekly eNewsletter below.