As the warmth of the sun and the natural beauty of Spring begin to return, so does the level of activity we have come to expect during this special time of the year for Brisbane, as it continues to be one of Australia’s top performing markets. However, many are wondering how the 2022 Spring will look off the back of a rapid market, coupled with increasing mortgage rates that are affecting consumer sentiment.

Using the latest data and insights from CoreLogic, we’ve compiled four key trends for you to be across this spring selling season.

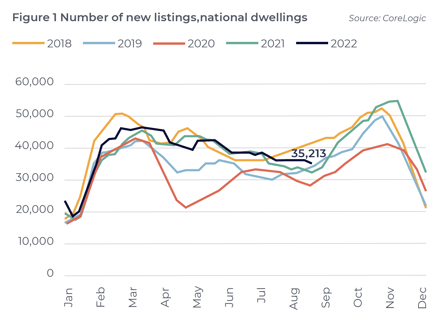

1. New listings and auctions will rise

Figure 1 shows the rolling count of new listings added to the market through 2022 every 28 days, compared with the four years prior. In the 28 days to September 4th, there were 35,213 new listings advertised across Australia, which is higher than the equivalent period in 2021, 2020 and 2019.

Despite new listings counts still trending lower, there are some data points that indicate a lift is on its way in the next few weeks. For example, ‘CMA activity’, which is a count of the Comparative Market Analysis reports generated across CoreLogic’s RP Data platform, rose 8.2%, in the final seven days of August, indicating that the seasonal lift in new listings is about to take off. This lift will have a flow-on effect to the Auction market.

2. It won’t be the bumper spring selling season we experienced last year

CoreLogic estimates there were 154,294 new listings added to the market through spring 2021, higher than the previous decade spring average of 144,985.

As we know, the market that Brisbane experienced from 2021 to early 2022 was abnormal, due to a variety of conditions put together to make for the perfect storm. The effect of these circumstances such as low interest rates and FOMO have cooled off, leaving us in a more normalised market.

3. Long-term owner-occupiers more likely to sell

A feature of a housing market that starts to decline is that the average hold periods of sold properties rise. This phenomenon is seen in figure 5, which shows the median hold period of national sales over a rolling 12-month period, compared with the annual change in dwelling values. Twelve-month hold periods have been elevated amid the current downturn.

This is because those who have held their property for longer are more likely to have made nominal gains, even if the market is going through a short-term, cyclical downswing. Whereas recent buyers are at more risk of making a nominal loss if they sell during a downturn.

4. Sellers will have to listen to buyer feedback, and be flexible on price

Properties are taking longer to sell, with median days on market up to 33 days in the three months to August, which has increased from a low of 20 days in November last year. The discounts between initial listing prices and contract sale prices have also become larger, with the median discount sitting at -4.0% nationally. This reduction in price is largely a function of rising mortgage rates, where buyers may not be able to afford as much debt as they could a few months ago.

Serious vendors must be realistic about their price expectations and ensure they have a quality marketing campaign behind the property in what is likely to be a more competitive selling environment through spring and early summer.

If you’ve been thinking about a new home and would like to know the facts about our current market, start by talking to your local Place agent today who can provide you with a no obligation, free appraisal of the current market value of your home.