As the COVID-19 pandemic and consequent economic recession continue to affect the day-to-day lives of all Australians, a national study has revealed the “silver lining” of the last several months.

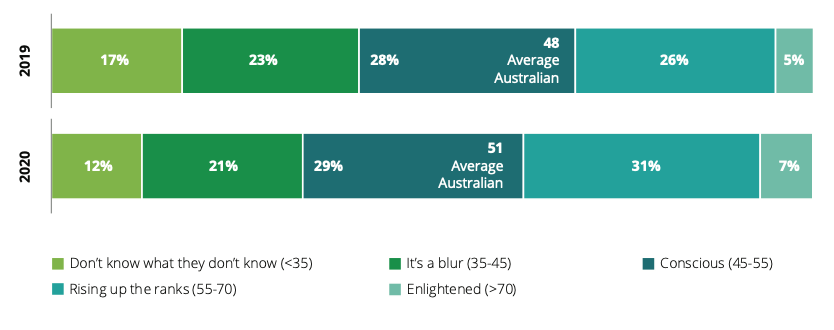

The Financial Consciousness Index (FCI), commissioned by comparethemarket.com.au and developed by Deloitte Access Economics, tested over 3,000 individuals for various factors from financial sophistication and financial willingness, to financial capability and financial wellness.

The annual report in its third consecutive year revealed that Australians are now more financially aware and are making better finically related decisions in an effort to minimise the personal impact of the current economic downturn by whatever means possible.

Source: Dollars and sense | Compare the Market’s Financial Consciousness Index

It also found that 8.9 million Aussies save at least 10% or more of their income each pay cycle, up by approximately 1.6 million people compared to those figures last year, with the proportion highest in ACT (52%), with Queenslanders least able to do so (41%). However, Queensladers were also just on the national average for overall financial consciousness, scoring 51/100 for the FCI test, up 3 points from last year.

David Ruddiman, General Manager of Digital Banking at Compare the Market opens the report with "The results show that this year’s tough economic climate has forced many Australians to become more proactive with their household budgets."

Although, the "silver lining" may be in preparation for the inevitable with Ruddiman then going on to say that while the health crisis had forced many people to be more conservative in their spending because of job security fears and reduced incomes, the lagging effect on the economy was the unknown right now.

“Unfortunately we do have a situation where 11 per cent of mortgages are in loan deferrals,” he said, with the top 20 authorised deposit-taking institutions seeing 11% ($195 billion) of their $1.8 trillion in mortgage related debt granted temporary repayment deferrals as at 30 June.”

Naturally, concern this year centred around global and Australian economic conditions. Whereas last year, 81% of people were concerned about Australian politics, this year concern dropped to 68%. As financial sentiment takes the greatest hit this year, 64% of Australians are lacking in confidence for conditions in 2020, up from 51% in 2019.

While Ruddiman outlines the rising concern centred around the current economic climate, "the 2020 Financial Consciousness Index reveals that while COVID-19 has put the financial consciousness of Australians on high alert, with time sentiment will recover as conditions continue to improve." he said. "Results already show that in spite of it all, Australians are optimistic about the future."